Table Of Content

There are some potential drawbacks to keep in mind when using them to move money from one bank to another, send payments, or pay bills. An improperly prepared deed could have severe consequences down the road. However, many title companies no longer help people prepare real property deeds and, as a result, often refer people to our office for low-cost help! Therefore, if you need to record the transfer of real property in California, contact A People’s Choice for more information. High-volume, low-dollar payments historically have had longer settlement times and are typically made via ACH (Same or Next Day Value), the check clearing systems or eventually Instant Payment methods. ACH debits and credits are transactions that are created, batched, and transmitted to an ACH operator, typically by way of a financial institution's connection to the ACH Network.

The Drawbacks of ACH Transfers

ACH transfers offer several advantages for a business of any size or industry. The payment amount is not considered one of the ACH instructions but will need to be included when making an individual transaction. In this guide, we’ll explain what an ACH transfer is, outline the different types of ACH transfers, and supply some basic steps on how to set up ACH transfers for you or your business. The Board and Reserve Banks provided comment on Nacha's December 1, 2017 request for comment on proposed rules to expand same-day ACH. This information may include links or references to third-party resources or content.

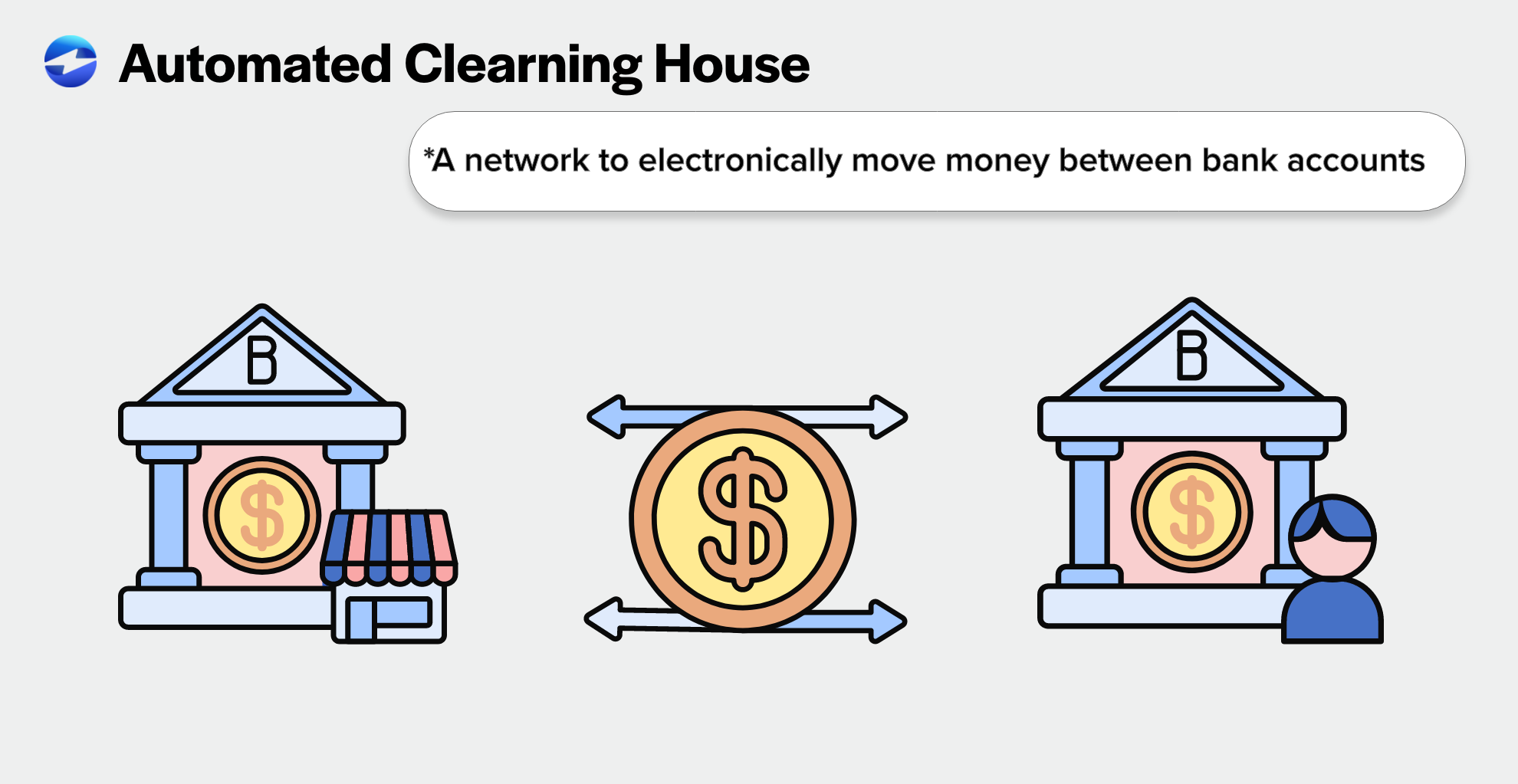

What is an ACH?

Day Cycle Definition - Banking - Investopedia

Day Cycle Definition - Banking.

Posted: Sat, 25 Mar 2017 20:13:54 GMT [source]

On the other hand, ACH payments are processed as a priority over traditional checks, which can be placed on “hold” while your bank confirms the check’s validity. However, ACH transfers are generally much cheaper than wire transfers. Wire transfers can run from $25 – $30 for transfers within the U.S. and between $45 – $50 for transfers outside of the U.S.

ACH Regulations (31 CFR Part

Read on to learn more about the various options available and which deed you require. Additionally, learn about documentary taxes and how you may be able to reduce or eliminate the amount you pay. Citi's ACH Control Total Verification feature provides an alternative method of entering File Control Totals for ACH Origination. Using this feature, users can submit approved transaction totals which will be used to verify the ACH file totals on the file received by Citi. If the file values received by Citi match the approved transaction totals, Citi will submit the file for straight-through processing.

Briefing: Binance.US Expects to Fix ACH Transfers in 24 Hours - The Information

Briefing: Binance.US Expects to Fix ACH Transfers in 24 Hours.

Posted: Wed, 29 Mar 2023 22:19:36 GMT [source]

We believe everyone should be able to make financial decisions with confidence. The information needed to complete an ACH transfer includes the account holder's name, the routing number, the ABA number, the account number, and the value to be transferred. Any discrepancies or differences created in the translation are not binding and have no legal effect for compliance or enforcement purposes. If any questions arise related to the information contained in the translated website, please refer to the English version. The California Housing and Community Development website uses Google™ Translate to provide automatic translation of its web pages. This translation application tool is provided for purposes of information and convenience only.

Amount limits – Some banks impose a daily, weekly, or monthly limit on ACH transactions, depending on the amount and type of transaction. Individuals may also be restricted from transferring money using ACH according to federal guidelines. In response to this tedious process, Nacha has rolled out same-day ACH payment processing. As the name implies, this allows for much speedier transaction times, although payments must be submitted by strict deadlines. ACH transfers, on the other hand, can only be used between U.S.-based accounts. Financial institutions that participate in ACH follow operating rules developed by Nacha, formerly known as NACHA – the Electronic Payments Association (Nacha), to transfer funds electronically.

Bank Account Number

For a transaction to occur, an entity must first make a direct deposit or payment using the ACH Network. The bank that completes the transaction takes the money, along with transactions made by others, packages them, and sends the funds at scheduled times throughout the day to the Federal Reserve or a clearinghouse. In other words, a wire transfer is your best option f you need to make an urgent payment or transfer money overseas, Conversely, for domestic payments that can wait a few days, ACH transfers usually make more sense.

Then, specify the transaction if it is credit or debit to the account where the transaction begins. After which, enter the payment, and lastly, be specific with the payment date. First, link accounts, for which you must supply the ACH instructions discussed above to the financial institution responsible for initiating the transaction. An ACH debit is riskier than an ACH credit, but both types of payments are just as convenient and cost-effective. In this case, the party initiating the payment will see an ACH debit reflected in their account.

ACH Transfer

An ACH credit is money deposited into your account through the ACH network. If an amount is credited to your account in error, then the individual or business that initiated the transfer may seek to have the money returned. In that scenario, the amount credited would be debited from your account.

Usually, wire transfers within the U.S. can run from $25-$30, and transfers outside the U.S. are mostly between $45-$50. However, there are some financial institutions that are unable to provide this service. The bank usually takes the greatest fall in cases of payment failure, especially if they do not adhere to NACHA recommended procedures and use risky practices when processing same-day ACH transfers. This has eliminated the need for customers to be reminded about delayed payments. Likewise, it has removed the hassle of writing paper checks and going to the bank. The digitization brought about by ACH payments meant that businesses no longer have to print and mail paper checks, which can be lost or stolen.

Nacha operating rules require that credits settle in one to two business days and debits settle the next business day. ACH transfers are transfers of funds using the ACH Network to move money from an account at one financial institution to another. Examples of ACH transfers include getting your pay through direct deposit or paying your bills online through your bank accounts.

ACH transfers are regulated and designed to prevent fraudulent transactions. They can also be safer than certified checks, cashier’s checks, or personal checks. It’s important, however, to initiate ACH transfers or receive them only from trusted entities. ACH transfers are typically scheduled between the following day or up to three days later. But same-day or almost immediate is also possible in some situations. Wires can be sent anywhere in the U.S. or overseas except to countries subject to U.S. sanctions, including Cuba, Iran, and North Korea.

You can send money online and pay your bills by setting up an account with either of these services and linking it to your credit or debit card. ACH transactions require the name of the financial institution receiving the funds, account type, routing/ABA numbers, and receiving bank account numbers. ACH transfers are different from wire transfers, which are a type of bank transfer that’s usually faster and more expensive.

If they need more for books and rent, you will be required to send more than one transfer. The Automated Clearing House traces its roots back to the late 1960s but was officially established in the mid-1970s. The payment system provides many types of ACH transactions, such as payroll deposits. It requires a debit or credit from the originator and a credit or debit on the recipient's end. The source of money you can send may come from your bank account, credit card, or an in-app balance.

To complete this step, you’ll need to supply the ACH instructions mentioned above to the financial institution responsible for initiating the transaction. The main differences between ACH and wire transfers are speed and cost. ACH (or Automated Clearing House) is a network used for transferring money payments electronically across the United States. The ACH network is governed by Nacha (National Automated Clearing House Association) and may also be referred to as the ACH scheme. A receiving bank has up to 3 days to reject the transaction for any number of reasons, including “account not found,” “insufficient funds,” or “closed account,” among others. Processing times - Even with same-day ACH, transactions can still take up to three days to process.

If you need a faster way to send money online, a social payment money transfer app can help. These apps allow you to send money to people using their email addresses or phone numbers. The money you send can come from your bank account, credit card, or an in-app balance. The ACH Network, or Automated Clearing House network, is a system in which funds are electronically transferred from one party to another.

No comments:

Post a Comment